The Italian economy almost comes to a halt according to Confindustria

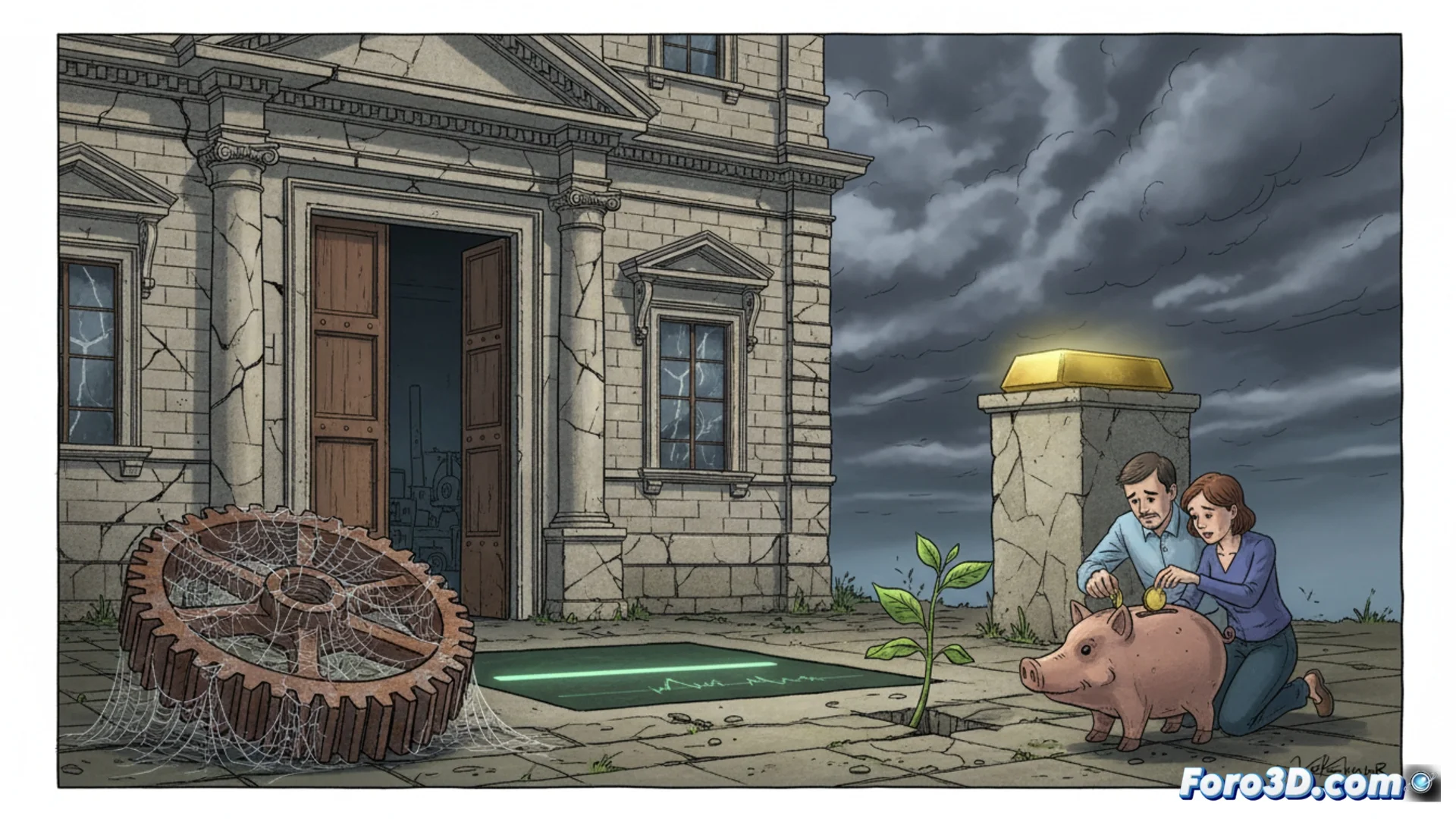

The main Italian industrial organization, Confindustria, reports that the country's economic activity is approaching a point of paralysis. Growth within the eurozone is losing strength due to multiple adverse factors pressuring various sectors. 🏭

Factors slowing economic expansion

A weak dollar makes it difficult for companies to sell their products outside Italy. At the same time, citizens within the country spend less, which reduces domestic demand. Industry operates with high volatility and energy and crude oil costs remain elevated. Uncertainty at the global level leads households to save more money, an attitude that coincides with the rise in the price of gold, an asset sought in times of financial tension.

Key elements of the economic slowdown:- A dollar exchange rate that does not favor selling abroad.

- Italian families reduce their purchases and consume less.

- Energy and oil prices remain at high levels.

Investors are key to improving GDP.

Positive counterpoints with limited effect

On the positive side, the National Recovery and Resilience Plan (PNRR) is advancing at a faster pace. Sovereign debt interest rates are falling and access to credit is increasing, offering some relief. However, Confindustria emphasizes that the role of investors is decisive for improving Gross Domestic Product. The economy as a whole still shows weakness and these positive factors do not fully manage to change the general direction toward stagnation.

Aspects that do not manage to reverse the trend:- The accelerated execution of the EU PNRR plan.

- The drop in Italian public debt interest rates.

- Greater access to loans and credit lines.

The global environment redefines decisions

International uncertainty not only impacts companies but also changes how households manage their finances. This widespread prudence helps explain why safe-haven assets like gold increase in value. While main indicators show mixed signals, recovery depends on positive measures taking hold and the global context gaining stability. It seems that the only sector that grows strongly is that of economic analysts, who seek new ways to describe the stagnation. 📉