Silver redefines its value in 2025 and 2026, driven by industry and investment

Long known as economic gold, silver is reaching unprecedented figures. Its role is no longer limited to protecting capital during instability; now it is an essential material for manufacturing modern technologies. This unique combination is rewriting the rules of the market. 📈

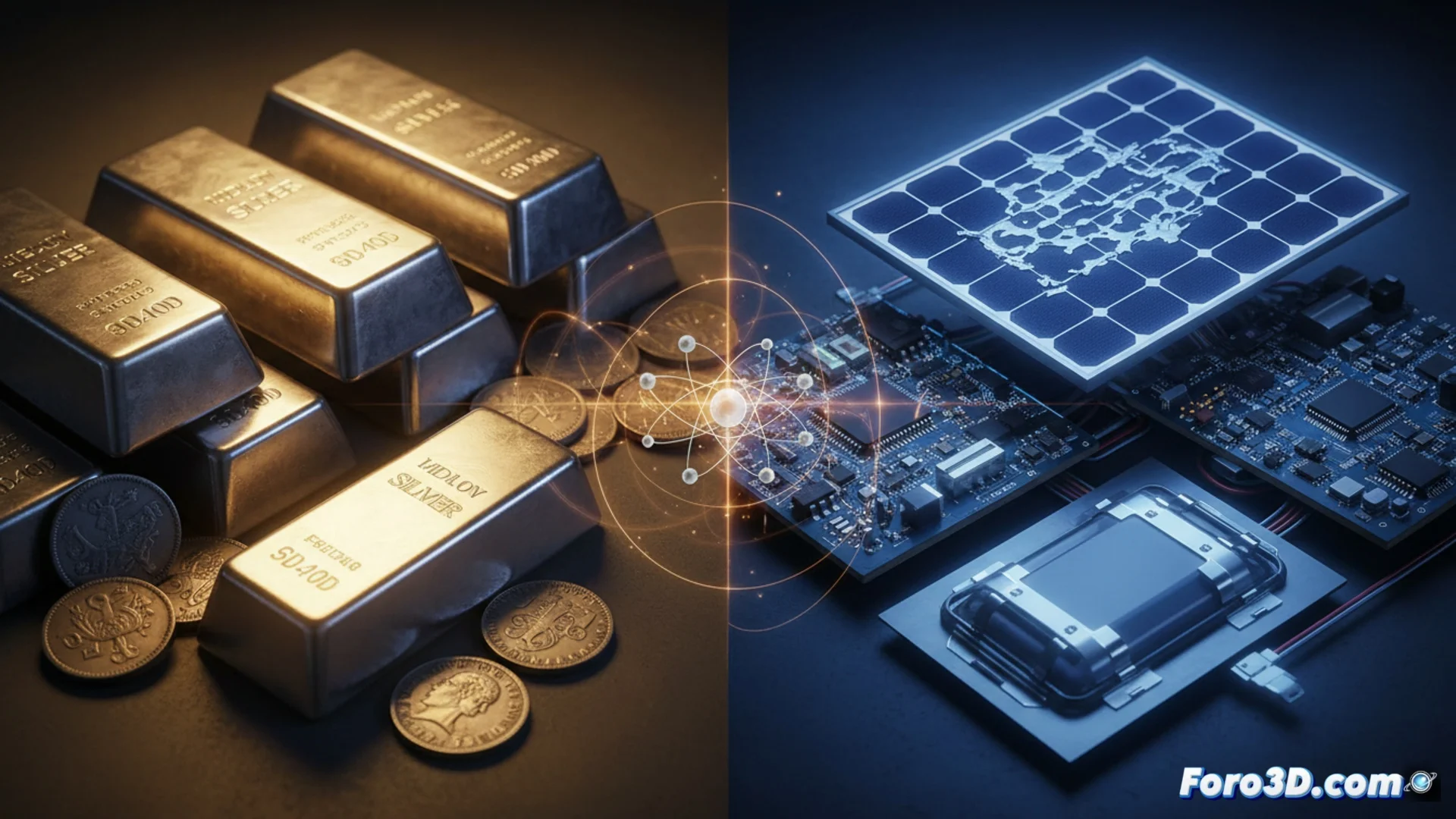

A dual engine: technology and financial protection

The value of this metal grows due to two main forces. On one hand, the energy transition and digital innovation require it massively. On the other, investors seek it as a store of value amid expectations that central banks will lower rates. This convergence generates constant upward pressure.

Key factors driving demand:- Solar energy: It is fundamental for producing photovoltaic cells in solar panels.

- Electric mobility: It is used in key components of electric vehicles and their charging stations.

- Electronics and data centers: Its properties for conducting electricity and heat make it irreplaceable in chips and server equipment.

Silver stops being a cheap alternative to gold to consolidate itself as a global strategic resource.

Mining supply struggles to keep up

While demand skyrockets, extracting more silver becomes a greater challenge. Many deposits, especially in Latin America, are old and their productivity decreases every year. This limits how much new metal can reach the market, creating a structural imbalance.

Limitations in production:- Aging deposits with lower ore grades.

- Lack of discoveries of new large-scale deposits.

- Higher operational and regulatory costs for extraction.

A shift in market perception

This new context definitively removes the label of secondary metal. Manufacturers compete to secure any available ounce to keep their production lines running. Simultaneously, investors who previously undervalued it now perceive it as a serious asset, capable of protecting their capital and benefiting from industrial growth. Silver has found a central role in the economy of the future. 🚀