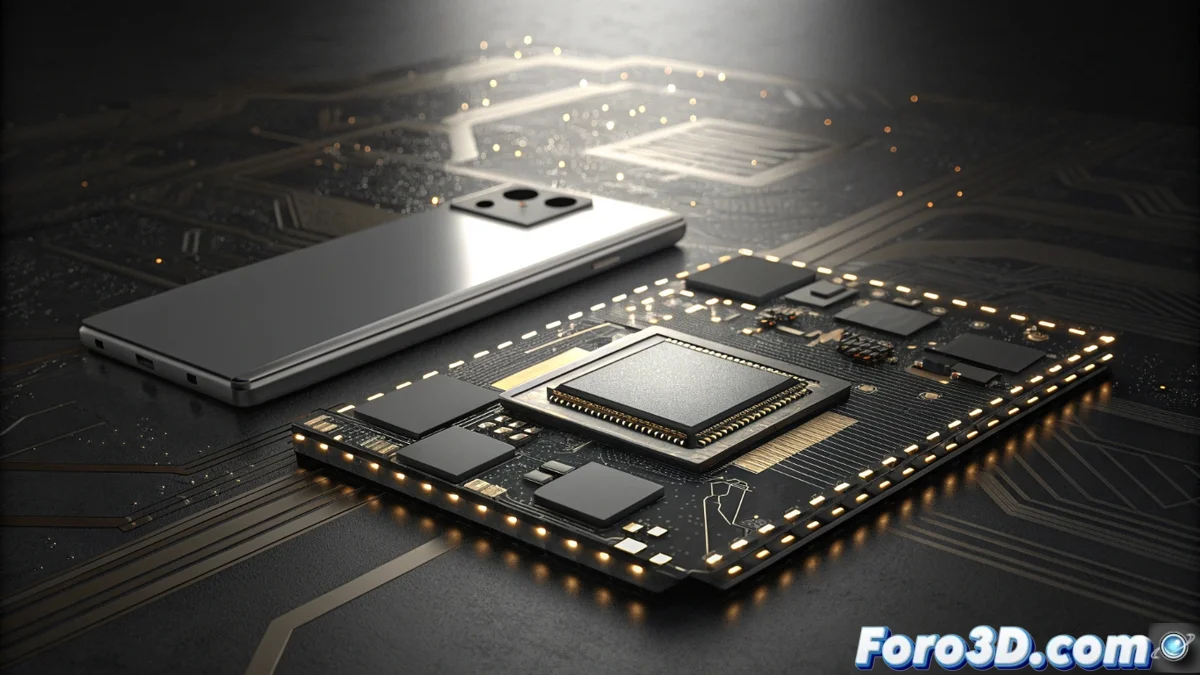

Samsung Prioritizes Margins Over Internal Pricing for Memory in Its Galaxy Line

In a revealing strategic move, Samsung Electronics has chosen to maintain a firm pricing policy for its latest-generation memory modules, refusing to grant preferential discounts even to its own mobile devices division. This decision directly affects the upcoming Galaxy S26, which will not benefit from reduced internal costs for LPDDR5X chips, marking a significant shift in the corporate dynamics of the tech giant. 🔄

A Pricing Discipline to Strengthen the Semiconductor Business

After a period of sharp decline in DRAM memory prices due to oversupply, the major market players, led by Samsung and SK Hynix, are implementing a coordinated strategy to regain profitability. Denying low-cost sales, even to internal customers, is a powerful signal to the entire industry. This stance aims to strengthen global LPDDR5X standard prices, avoiding setting a dangerous precedent for aggressive discounts that other buyers might demand later. The goal is clear: prioritize the financial health of the chip business after challenging quarters. 💹

Key Implications of This Internal Policy:- Manufacturing Costs: Samsung's mobile division will have to absorb memory costs at market prices, without the expected benefit of vertical integration, which could pressure the Galaxy S26's margins.

- Market Stability: The measure helps sustain LPDDR5X prices for all manufacturers, aiding the overall memory sector's recovery.

- Signal to Competition: It demonstrates Samsung's commitment to strict pricing discipline, influencing the strategies of other players like Micron or SK Hynix.

"The left hand bills the right hand at wholesale catalog prices. It's a lesson in corporate priorities where group results take precedence over internal savings." – Analysis of corporate dynamics.

Consequences for the Galaxy S26 and Mobile Ecosystem

For the design teams of the next flagship, the Galaxy S26, this policy translates into a more expensive key component than anticipated. This could force engineers to seek cost optimizations in other areas of the device, such as the display, battery, or camera, or accept tighter profit margins on the final product. At the same time, this decision has an interesting collateral effect on the competition. Manufacturers like Xiaomi, Oppo, or Google, who also purchase memory from Samsung, will not face such a pronounced cost disadvantage, as the Korean giant does not grant itself special treatment either. This partially levels the playing field in acquiring this critical component. ⚖️

Effects on the Supply Chain and End Consumption:- Competitive Balance: Other smartphone manufacturers avoid an unfair disadvantage in memory pricing, maintaining more balanced competition in components.

- Pressure on Final Prices: The higher manufacturing cost for Samsung could be passed on, at least partially, to the Galaxy S26's retail price, or reduce per-unit profitability.

- Product Strategy: Samsung Mobile may be forced to make tough decisions on specifications or pricing structure for its high-end range to offset memory costs.

Final Reflection: Corporate Profitability vs. Internal Advantage

This Samsung decision underscores a fundamental economic reality in tech conglomerates: sometimes, the interests of one division (semiconductors) must take precedence over the convenience of another (mobiles) to ensure the group's overall profitability. It's a fascinating example of internal accounting and long-term strategy. As the memory market consolidates and seeks stability, end consumers will likely be the ones who ultimately feel the consequences of these decisions, whether in the price tag or the features of upcoming flagship devices. The era of generous internal discounts may be coming to an end in pursuit of greater financial discipline. 💼