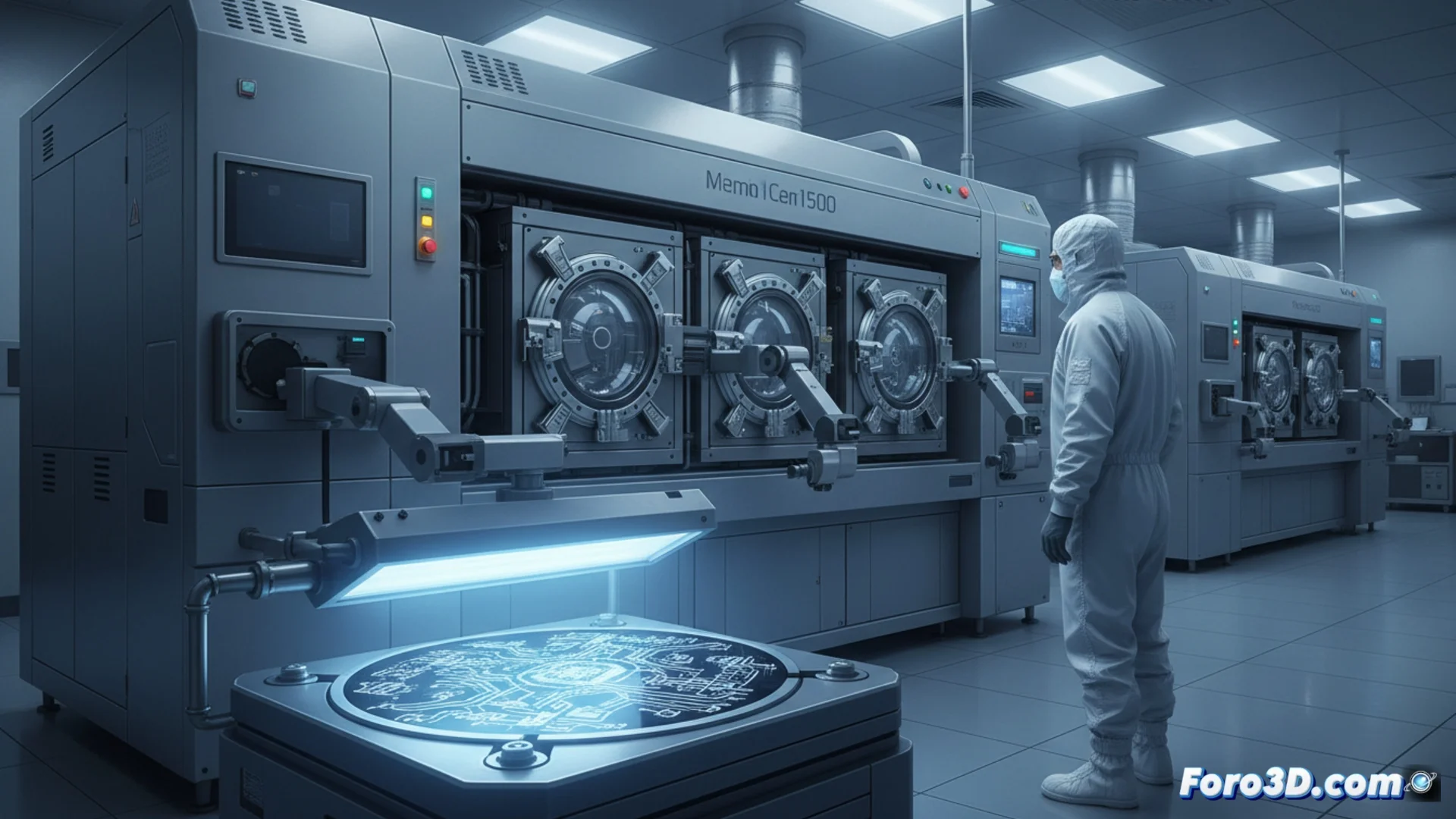

China Advances in the Global Chip Manufacturing Equipment Market

The map of the leading suppliers of machinery for producing semiconductors is transforming. A recent analysis indicates that three Chinese companies are now part of the global top 20, increasing their presence compared to the previous year. This change shows how the local industry is accelerating to replace foreign technology and consolidate its own supply networks. The progress is significant, given the high technical complexity and barriers of a sector historically controlled by corporations from the United States, Japan, and Europe. 🚀

Naura Technology Group Reaches a Leadership Position

In this context, Naura Technology Group emerges as a standout case. Founded more than two decades ago, the Chinese firm climbed from eighth to fifth place in the global ranking, driven by revenue growth exceeding 20% in the last year. Naura designs and produces essential equipment for processing silicon wafers, including systems for depositing chemical layers and etching circuits at a microscopic scale. It now positions itself right after the four undisputed giants: ASML (Netherlands), Applied Materials and Lam Research (USA), and Tokyo Electron (Japan). Its trajectory demonstrates the ability of Chinese companies to create competitive technology in specific links of the value chain. ⚙️

Key Factors in Naura's Rise:- Solid Growth: A 21% increase in annual revenue was the main driver for climbing positions in the global ranking.

- Technical Specialization: It focuses on manufacturing critical equipment for key stages of wafer processing, such as deposition and etching.

- Strategic Positioning: It now competes directly in the segment just below the historical market leaders.

Progress in other areas is significant and is reconfiguring global supply flows.

The Drive for Import Substitution

This rise is not an isolated event. It responds to a national strategic effort, backed by sustained investment, whose primary goal is to reduce dependence on external suppliers. Geopolitical tensions and export restrictions on advanced technology to China have considerably accelerated these plans. As a result, local chip manufacturers are increasing their orders from national companies, allowing them to invest more in research and development and expand their production capacity. Although a gap persists in machines of extreme complexity, such as extreme ultraviolet (EUV) lithography systems, advances in other equipment are altering the dynamics of global supplies. 🌍

Elements Shaping the New Landscape:- Self-Sufficiency Policy: It is a priority goal for Beijing, driving investment and support for the local sector.

- Geopolitical Context: Trade restrictions have acted as a catalyst to accelerate the development of domestic technology.

- Domestic Demand: Chinese semiconductor manufacturers are turning more to domestic suppliers, creating a virtuous cycle of investment and growth.

A Future with More 'Made in China'

The chip manufacturing landscape is incorporating a new reality. Now, the machines that etch semiconductor circuits can carry the 'Made in China' label with the same prominence as many of the electronic devices we use daily. This movement not only reflects a change in rankings but a deeper transformation in global supply chains, where China is determined to gain autonomy and technological presence. The path still has challenges, but the direction and momentum are clear. 🔌