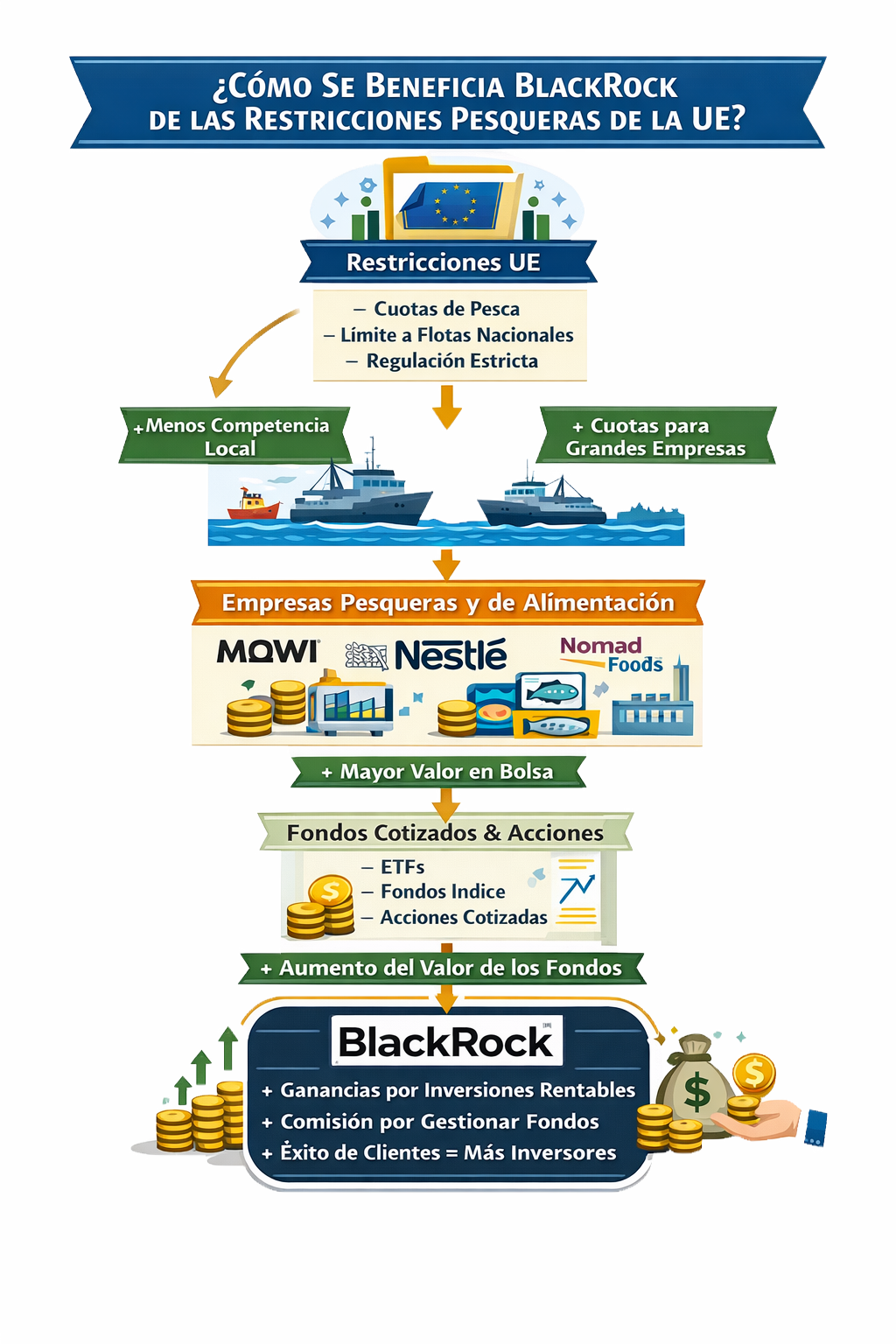

BlackRock Benefits from EU Fishing Policies Without Operating in the Sector

The investment manager BlackRock obtains economic returns from EU regulations on fishing, despite having no direct activity in this field. The rules of the European Union, designed to protect fishing grounds, restrict operations for smaller local fleets. This scenario reduces market rivalry, benefiting larger aquaculture and fishing corporations that can adapt their methods to the new legislation. 🎣

The Link with Major Sector Corporations

BlackRock holds significant shareholdings in many of these large companies through its investment funds. Among its holdings stand out shares in the Norwegian aquaculture giant Mowi ASA, a global leader in salmon production. It also invests in other key European firms dedicated to processing and marketing seafood products. When these companies increase their margins due to a market with fewer competitors, the value of their shares rises. BlackRock, as a shareholder, profits from this appreciation. 📈

Mechanism Behind the Financial Gain:- The link is exclusively financial. BlackRock does not set catch quotas or manage vessels.

- Its benefit comes from the increase in the value of its investment portfolios.

- The restrictions act as an external element that can make revenues more predictable for large sector firms.

A policy to conserve marine resources indirectly generates a market environment that favors large players and their institutional investors.

How Regulations Shape the Market Landscape

This greater stability attracts more investors, which pressures share prices to rise. Thus, legislation intended to safeguard the marine ecosystem ends up consolidating the position of the largest players. The paradox is evident: rules aimed at protection end up strengthening the "big fish" in the financial realm. 🐟➡️💰

Key Outcomes of This Scenario:- Large fishing corporations consolidate their position and improve their financial strength.

- Effective competition in the market is reduced by limiting smaller-scale operators.

- Institutional investors like BlackRock see their stakes appreciate without intervening in the sector's operations.

Conclusion on the Indirect Financial Impact

In summary, the case shows how regulatory policies in a specific sector can have unexpected financial consequences in capital markets. BlackRock capitalizes on this situation through its shareholdings, demonstrating that benefits can flow to purely financial actors far from actual productive activity. The regulatory ecosystem, therefore, not only shapes the fishing industry but also the investment flows surrounding it.